Finance teams lose hours every week to repetitive tasks like chasing invoices, updating spreadsheets, sending payment reminders, and tracking expenses. These manual processes slow you down, create errors, and keep your team stuck doing data entry instead of strategic work.

AI automation for finance solves these problems without requiring technical skills. Diaflow's no-code templates connect Gmail, Google Sheets, and Diaflow Drive to handle the busywork automatically. The result? Better accuracy, full visibility, and hours back every week.

Why Finance Teams Need Automation

Manual finance work has a ceiling there are only so many hours in a day. Your team can process 50 invoices a week, but not 500. And every manual task carries risk: a mistyped number, a missed email, or an invoice lost in someone's inbox.

Automation removes these limits. Workflows run 24/7 with perfect consistency, handling twice the volume without adding headcount. Your team gets real-time data visibility and spends their time on strategic work analysis, planning, and decision-making instead of data entry.

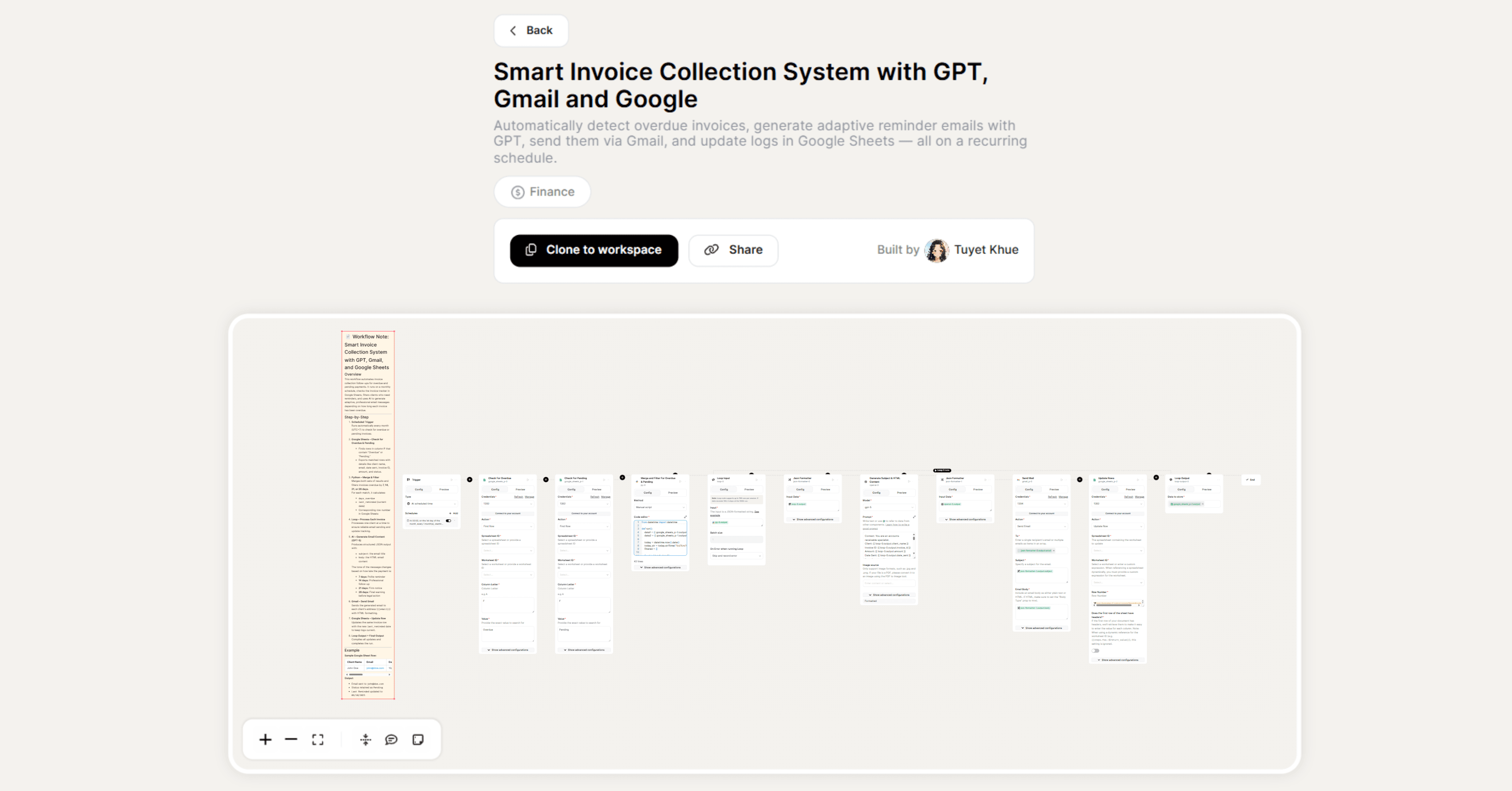

1. Smart Invoice Collection with GPT, Gmail, and Google Sheets

What it does: Monitors Gmail for vendor invoices, extracts key information (invoice number, vendor name, amount, due date, line items) using GPT, and logs everything in Google Sheets. Works with PDFs, images, or text invoices.

Why it matters: Manual invoice collection means opening every email, downloading attachments, and entering data time-consuming and error-prone. This automation captures every invoice when it arrives with consistent formatting, giving you real-time visibility into payables without hunting through emails.

Time saved: 5-10 hours per week on invoice data entry and tracking.

Diaflow tip: Connect this workflow to your accounting software or payment approval process so invoices flow automatically from collection to payment.

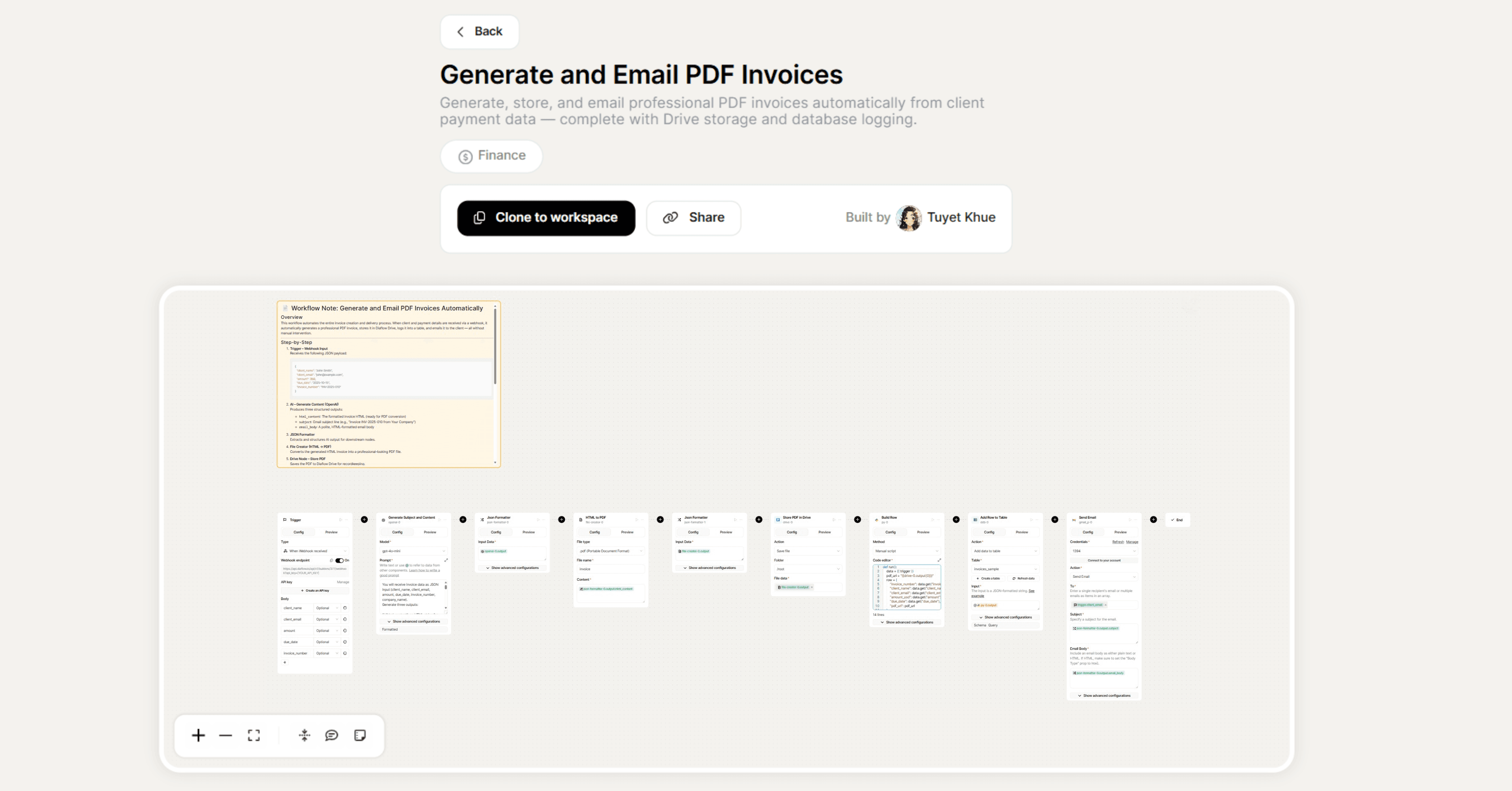

2. Generate and Email PDF Invoices Automatically

What it does: When you update billing data in Google Sheets (completed projects, subscription charges, product shipments), this workflow creates a professional PDF invoice and emails it to your customer with payment details.

Why it matters: Creating and sending invoices manually, formatting, exporting, drafting emails, and attaching files is pure administrative overhead. This automation eliminates every step while ensuring invoices go out immediately. Faster invoicing means faster payment and improved cash flow.

Time saved: 3-7 hours per week on invoice creation and delivery. Companies reduce DSO by 15-30% with immediate invoice delivery.

Diaflow tip: Set up trigger rules based on project status or date milestones so recurring invoices generate automatically.

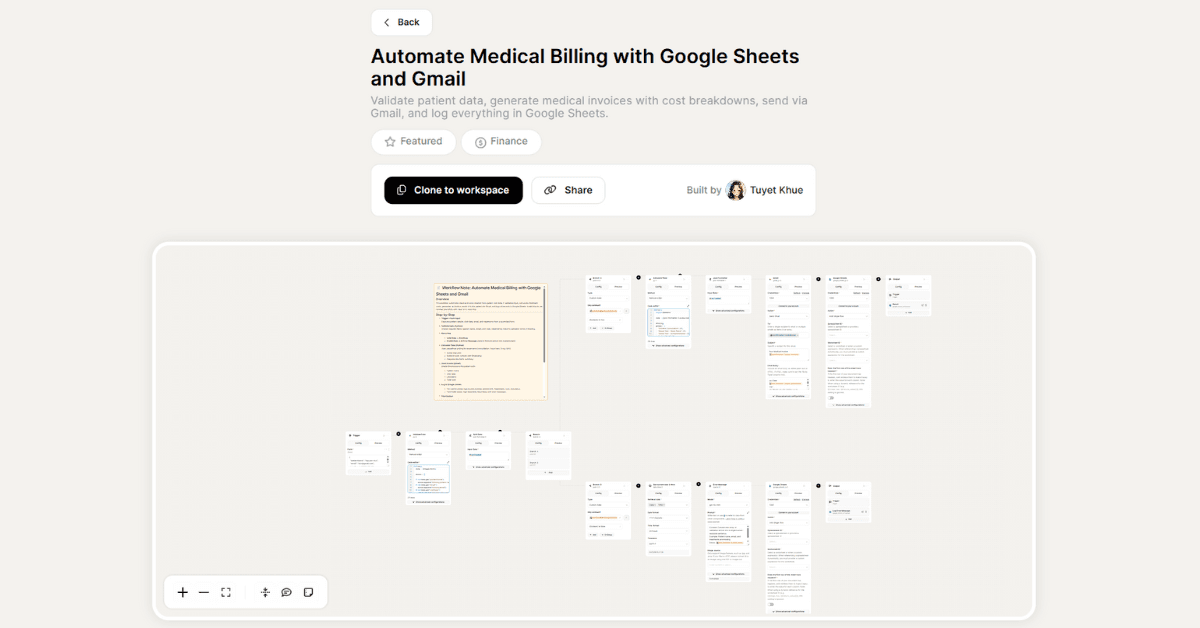

3. Automate Medical Billing with Google Sheets and Gmail

What it does: Pulls patient and procedure information from Google Sheets, generates medical bills or insurance claims with proper codes (CPT/ICD), and sends bills to patients or submits claims to insurance providers automatically.

Why it matters: Medical billing requires complex, accurate data patient information, insurance details, procedure codes, and provider data. Manual entry is slow and causes claim denials. This automation handles the complexity, validating codes before submission to reduce errors and speed up reimbursement.

Time saved: 60-70% reduction in processing time per claim. Billing specialists can handle 2-3x more claims with fewer errors.

Diaflow tip: Build in validation rules that check for common denial triggers (missing codes, mismatched patient IDs) before submitting claims.

4. Automated Trip Expense Claims with OpenAI & Drive

What it does: Employees submit expense receipts through a form, OpenAI extracts merchant names, amounts, dates, and categories from receipt images, and the system organizes everything in Diaflow Drive and Google Sheets. Automatically flags policy violations.

Why it matters: Traditional expense reimbursement frustrates everyone—employees lose receipts, finance teams spend hours on manual entry. This automation lets employees photograph receipts while AI handles extraction and categorization. Finance gets clean, organized data ready for approval, and employees get reimbursed faster.

Time saved: 70-80% reduction in expense processing time. Finance teams save 4-8 hours per week on manual entry and receipt organization.

Diaflow tip: Set up automatic approval for expenses under a certain threshold (like $50) so small claims process immediately without manager review.

5. Generate PDF Invoices and Store in Drive

What it does: When billing data appears in Google Sheets, it generates a formatted PDF invoice and stores it in an organized Diaflow Drive structure with consistent naming (by customer, date, or invoice number).

Why it matters: Many teams can generate invoices but struggle with organization and retrieval. Invoices get saved randomly or lost. This workflow builds a searchable, organized archive automatically. During audits or customer inquiries, you can locate any invoice in seconds instead of hours.

Time saved: 2-4 hours per month on invoice searches. During audits, it saves days of document retrieval work.

Diaflow tip: Use date-based folder structures (Year/Month/Customer) so you can quickly pull all invoices for a specific period during month-end close.

6. Generate Invoices, Save to Drive, and Send Email

What it does: Combines invoice generation, organized storage, and customer delivery in one workflow. Updates in Google Sheets trigger automatic invoice creation, filing in Diaflow Drive, and email delivery to customers with personalized messaging.

Why it matters: This is complete accounts receivable automation, eliminating every manual step from data entry to customer delivery. Invoices reach customers immediately when work is completed, accelerating cash collection while your team focuses on collections strategy and payment reconciliation.

Time saved: 8-15 hours per week on invoice processing. Companies reduce DSO by 20-35% with immediate invoice delivery.

7. Invoice Processor & Validator with AI & Google Sheets

What it does: Before finalizing invoices, AI validates them against your business rules—checking calculations, required fields, and data consistency with your Google Sheets database. Flags discrepancies for human review while valid invoices proceed automatically.

Why it matters: Invoice errors cause delayed payments, customer frustration, and extra work fixing mistakes. Manual validation is tedious and suffers when teams rush. This automation catches problems before they leave your organization, ensuring every invoice meets quality standards without slowing your process.

Time saved: 85-95% reduction in invoice errors, saving 3-6 hours per week on corrections. Payment delays drop 40-60% with first-pass accuracy.

Start Automating Your Finance Team

These workflows address real pain points finance teams face daily, from invoice chaos to expense tracking headaches. The good news? You don't need technical skills to get started. Pick one workflow that solves your biggest bottleneck, implement it using Diaflow's ready-made templates, and watch the hours add up.

As your first automation runs smoothly, you'll spot other opportunities to eliminate manual work. That's when finance workflow automation becomes transformative, not just saving time on one task, but changing how your team operates.

Ready to get started? Explore Diaflow's finance automation templates or build your own workflow in minutes. Your finance team has better things to do than data entry.

Wrap Up

Today, we've explored 7 essential automation workflows across finance operations:

- Invoice Management: Smart invoice collection and automated PDF generation for faster processing

- Medical Billing: Automated claims with proper codes for reduced denials

- Expense Processing: AI-powered receipt extraction and policy validation

- Document Organization: Automated filing and storage for instant retrieval

- End-to-End Automation: Complete workflows from invoice creation to customer delivery

- Quality Control: AI validation to catch errors before they impact payments

These specialized workflows handle common finance use cases well. But when you need automation that fits your exact workflow, combining multiple tools, connecting to your specific systems, or following your unique business logic, Diaflow's visual approach lets you build production-ready custom workflows without extensive coding.

FAQs

Q1: Is my financial data secure with these automations?

Diaflow follows enterprise-grade security standards. Your data stays within your connected systems (Google Workspace, etc.), and workflows process information without storing sensitive data unnecessarily.

Q2: Will this replace my finance team?

No. Automation handles repetitive tasks so your team can focus on analysis, planning, and decision-making, where human judgment adds real value.

Q3: What if my invoices have different formats?

AI extracts data from PDFs, images, and text regardless of format. The system adapts to various invoice layouts automatically.

How Diaflow Transforms Finance Operations with AI

Diaflow helps finance teams escape data entry and focus on strategic work. Our no-code automation combines with AI to handle invoice processing, expense management, and billing, giving you hours back every week.

Whether processing 50 invoices or 500, Diaflow eliminates errors, improves cash flow, and scales without adding headcount. Start with one workflow today and transform your finance operations. Save time, reduce errors, and make automation your competitive advantage.