The insurance industry has never been known for its speed or boldness. But artificial intelligence is forcing a reinvention. Not through incremental improvements, but through fundamental rewiring of how the entire system operates.

Nearly 80% of insurance companies are already exploring AI, yet a similar number admit they haven’t seen real financial gains. That’s the catch: adopting flashy new tech isn’t the hard part. The challenge is integrating it deeply — into workflows, decisions, culture, and customer experience. The ones who do will pull away. Fast.

Claims Processing Just Got a Full System Reset

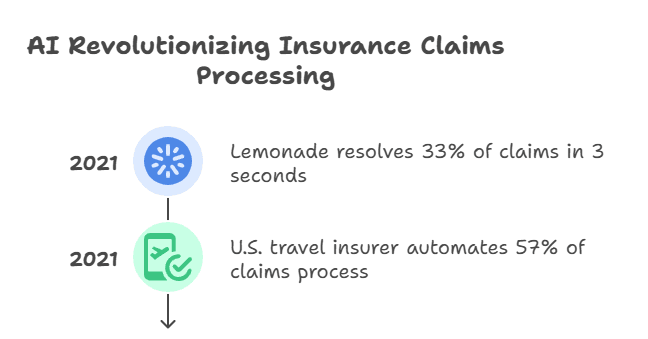

The most dramatic AI changes are happening in claims. What used to be weeks of paperwork, phone calls, and delays is now being compressed into minutes — or less.

In 2021, Lemonade made headlines by resolving over a third of claims in just three seconds, completely autonomously. Meanwhile, a major U.S. travel insurer transformed its manual claims operation — over 400,000 claims a year — by automating 57% of the process, cutting resolution time from weeks to minutes.

It’s not just about speed. It’s about precision. AI slashes the human errors that cause claims leakage — the kind that quietly eats up to 30% of payouts. Adjusters now handle 40 to 50% more cases, and instead of being buried in routine tasks, they focus on edge cases where real expertise and empathy are needed. AI doesn’t replace the human touch — it clears the path for it.

Underwriting Is No Longer Guesswork

AI is handing underwriters analytical firepower they never had before. Instead of sifting through outdated models or historical assumptions, they can now analyze enormous volumes of real-time data — from telematics to credit scores to behavioral patterns — and produce accurate risk assessments instantly.

Zurich saw a 90% jump in risk assessment accuracy after adopting a modern, AI-powered platform. This kind of adaptive underwriting moves beyond hindsight. It becomes a live system, responsive to emerging threats like cyber risk or climate volatility. Pricing becomes more personalized, more equitable, and far more intelligent.

AI Is Making the Customer Experience Feel More Human

AI isn’t just transforming the back office — it’s reshaping how insurers interact with the people they serve. And ironically, it’s making those interactions feel more personal.

Round-the-clock AI chatbots are becoming smarter with every conversation. They handle the simple stuff so that human teams can focus on the harder, more nuanced ones. More importantly, AI enables real personalization: nudging a customer about a policy renewal at just the right time, or recommending usage-based coverage that actually fits their lifestyle.

This shift matters. In a sector where 30% of claimants leave dissatisfied — and most blame slow or clunky service — showing you get your customers is the real differentiator.

AI Is the Fraud Detective the Industry Has Always Needed

Fraud is a massive, often invisible cost in insurance. AI, with its ability to detect anomalies across vast data sets, is already proving to be a powerful defense.

Where human auditors might miss subtle signs, AI can flag them in seconds — spotting suspicious claims and reducing fraud-related losses by up to 40%. That’s not just good for insurers. It protects honest customers and keeps the entire ecosystem cleaner, faster, and fairer.

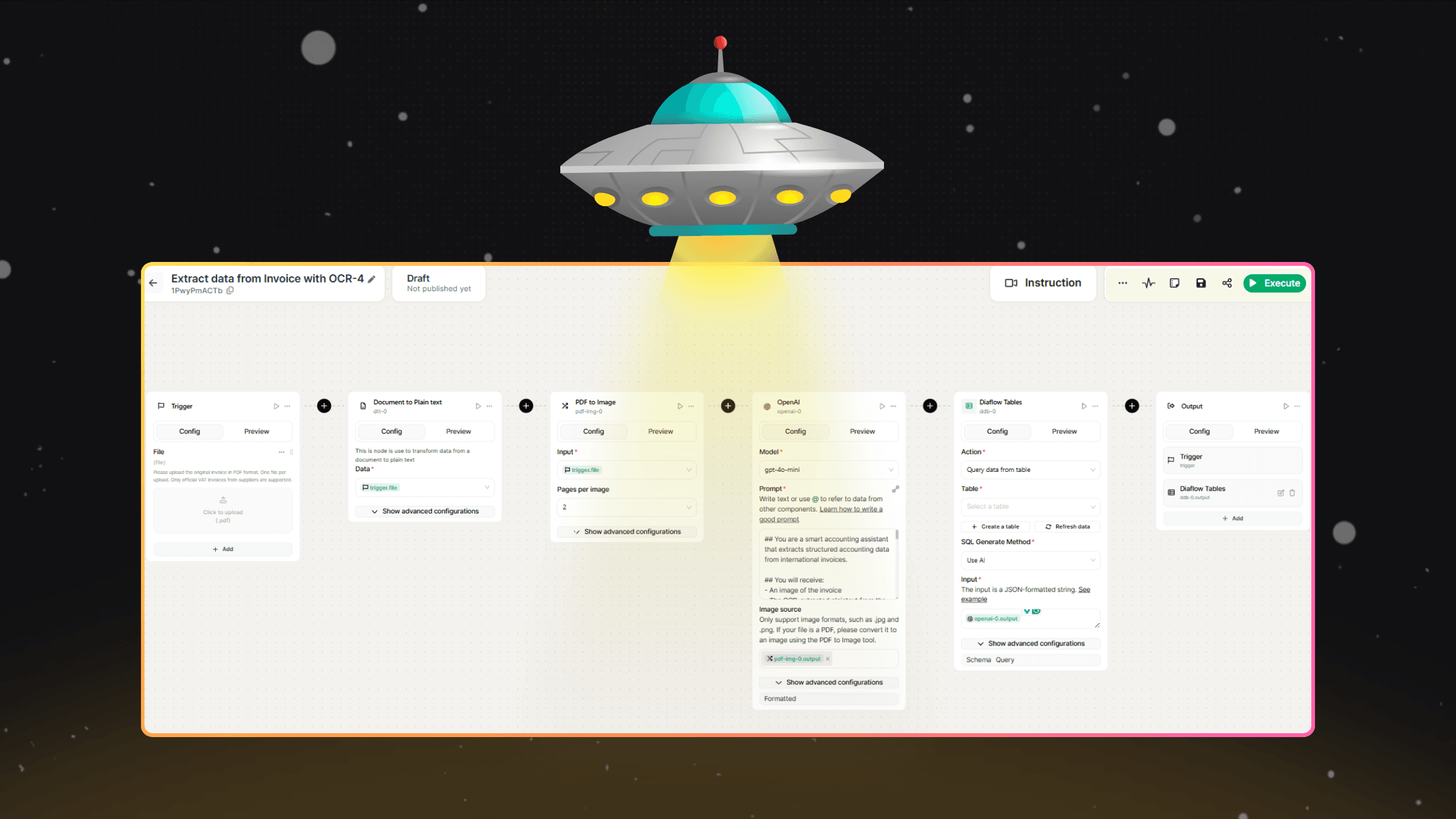

Low-Code Platforms Are the Real Accelerator

Behind this wave of transformation is a new generation of low-code platforms. These tools let business users — not just developers — design and deploy solutions quickly, without writing a single line of code.

This means product teams can respond to regulatory changes, market shifts, or customer demands in days instead of months. Even better, these platforms are built with compliance and security in mind, which is non-negotiable in a sector as heavily regulated as insurance.

This isn’t just a technical shift. It’s a cultural one. Innovation isn’t siloed anymore — it’s distributed, democratized, and fast.

AI Isn’t a Project. It’s a Business Strategy.

Insurers who’ve gone all-in on AI are already seeing results: customer retention is up 14%, Net Promoter Scores have risen nearly 50%, and operational costs are dropping. The global insurance AI market is projected to hit $14 billion by 2034 — and some forecasts suggest it could add $1.1 trillion in value every single year.

Yet the real obstacles aren’t technical. They’re cultural. Legacy systems still lock away critical data. Outdated mindsets resist change. For AI to deliver real business outcomes, it takes more than clever software — it requires leadership with vision, organizations ready to change, and teams willing to learn.

Bottom Line

AI isn’t just about doing the same old things faster. It’s about discovering entirely new ways to create value, deliver trust, and redefine what customers expect from insurance.

The winners in this space won’t be the ones experimenting on the sidelines. They’ll be the ones leading from the front — rebuilding their companies around AI as a core capability. This is no longer a question of technology adoption. It’s a question of survival.

How Diaflow Accelerates AI Transformation in Insurance

Diaflow helps insurers move beyond experimental AI by embedding automation into core workflows—claims, underwriting, and customer experience. As shown in this blog, AI is transforming the industry from the inside out.

With Diaflow’s no-code platform, teams can build fast, accurate, and compliant solutions—without needing to code. It’s the fastest way to modernize operations, reduce risk, and deliver smarter, more human-centered insurance.