Artificial Intelligence (AI) is no longer a thing of science fiction; it’s something we use every day—even in finance. From helping detect fraud to managing investments, Finance AI (using AI in financial services) is making tasks easier, faster, and safer.

In this article, we’ll explore the power of Finance AI, how it is used in the financial sector, and how it revolutionizes traditional processes.

So, What Is Artificial Intelligence (AI)?

Let’s break it down: you can understand that Artificial Intelligence is when machines or systems are designed to act like humans. They can "think" and "learn" to do tasks that require human effort.

For example, an AI system can analyze data, spot trends, and even make decisions. What makes AI special is that it doesn’t need constant supervision—it improves on its own by learning from experience.

Let's talk about Finance AI

Finance AI involves applying AI technologies like machine learning (ML) and advanced analytics to the financial sector. These technologies allow financial institutions to analyze massive datasets, automate workflows, and make smarter decisions.

Some things Finance AI helps with:

Why Is Finance AI Important?

Finance AI makes life easier for customers, employees, and businesses. Here are some reasons why it’s a game-changer:

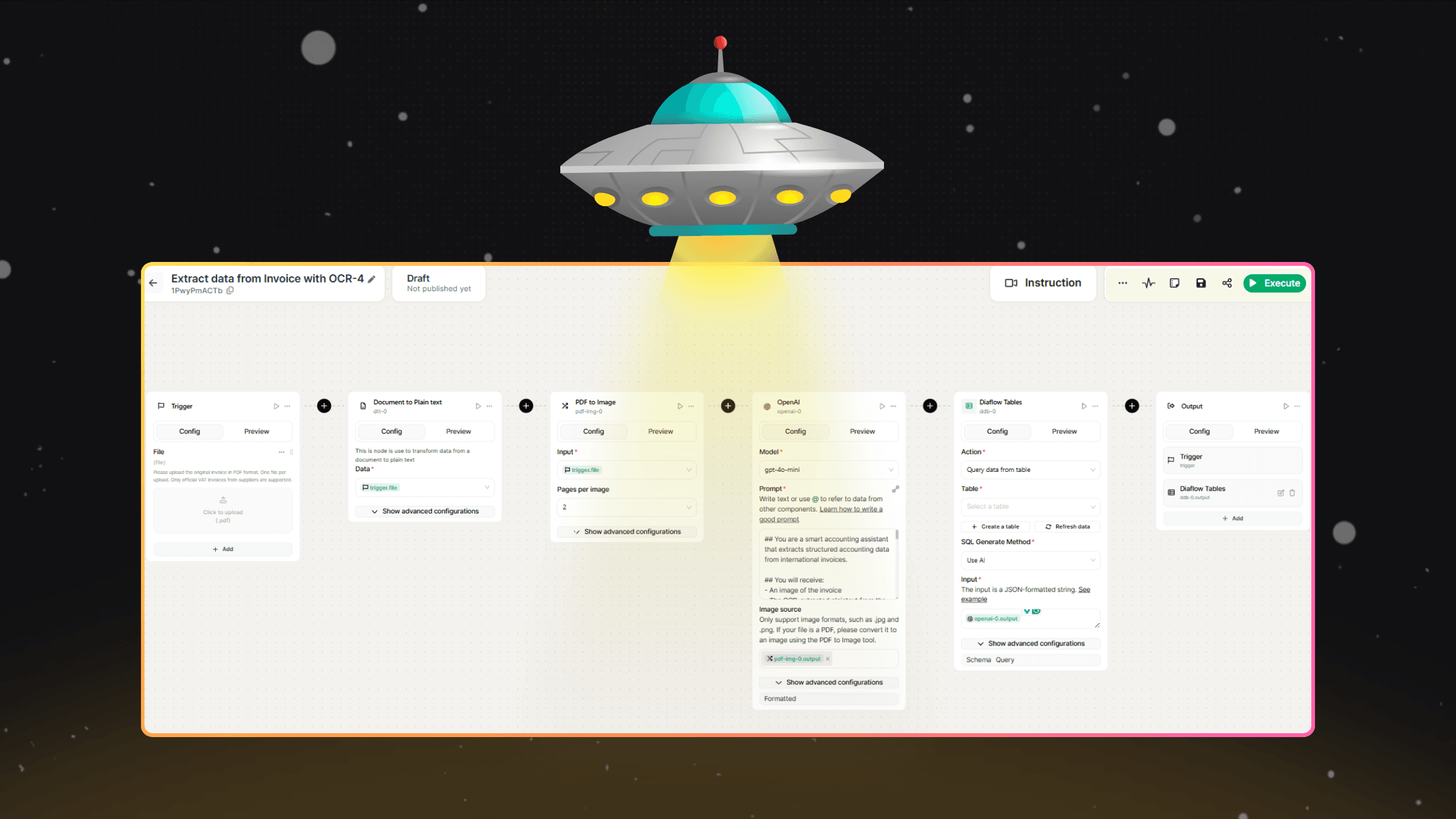

AI can process thousands of transactions or analyze massive amounts of data in seconds. For example, instead of a person manually checking every invoice, an AI system can scan and process them all in no time (you can try this by using Diaflow template 😁).

Humans can make mistakes, especially when dealing with complex financial tasks. AI systems are programmed to work accurately, reducing the risk of costly errors.

By automating processes, businesses need fewer resources to get the job done. This means they can focus more on serving customers or growing their business.

How AI Is Changing Finance

Making Tasks Simpler

In the past, financial systems relied on strict rules. For example, a system might need a person to program every single step. AI changes this by learning on its own.

Example: AI learns how to process invoices by recognizing patterns in the data, so it doesn’t need constant updates from humans.

Predicting the Future

AI doesn’t just look at what has happened—it predicts what might happen.

Helping Businesses Grow

AI can handle large amounts of data, which makes it perfect for businesses looking to expand.

Examples of Finance AI in Action

Automating Manual Processes

AI transforms mundane processes like accounts payable and receivable. For instance, Oracle’s ERP system automates invoice scanning and data entry, minimizing manual errors while improving fraud detection.

Accelerating Financial Close

AI reduces the time spent consolidating and reporting financial data. Oracle, for example, closes its financial books in just 10 days compared to industry norms of 20 days.

AI-Powered Digital Assistants

Digital assistants powered by AI simplify expense management and compliance. These tools can:

Algorithmic Trading and Portfolio Management

AI algorithms analyze market data in real-time, making decisions faster than human traders.

Benefits:

Why Should Beginners Care About Finance AI?

If you’ve ever worried about managing your money, getting scammed, or making the wrong investment, Finance AI is here to help. It makes managing finances simpler, safer, and smarter—even if you’re not an expert.

FAQs

What is Finance AI in simple terms?

Finance AI is the use of smart machines to handle money-related tasks, like detecting fraud or managing investments, faster and more accurately than humans.

How does AI help with fraud detection?

AI systems analyze transaction patterns and flag anything suspicious, like unusual spending or account access from different locations.

Can AI replace financial advisors?

No, but it can assist them. While AI is great at analyzing data, human advisors are still needed for complex decision-making and personalized advice.

Is Finance AI safe to use?

Yes, as long as businesses follow strong security measures to protect sensitive data.

How does AI help beginners manage their money?

AI-powered apps can help track spending, suggest budgets, and even recommend investments based on your goals.

What’s the biggest advantage of Finance AI?

It saves time and reduces errors, making financial tasks easier for both individuals and businesses.